Chapter 4 – Saving with Bitcoin

Embark on the journey and start stacking sats!

Table of contents

- Section 1 – The price of Bitcoin

- Section 2 – Buying Bitcoin

- Section 3 – Working for bitcoins

- Section 4 – Hyperbitcoinization

Section 1 – The price of Bitcoin

Number go up technology

October 5, 2009 marks the first public valuation of Bitcoin.

1 BTC = $0.001. I’ll let you do the math.

Bitcoin is a different asset, a UFO in finance. Misunderstood by the elites and disparaged by Wall Street, it has managed to grow in the shadows and can no longer be dismissed today. After 4-7 speculative bubbles, Bitcoin is still alive and its adoption is once again changing focus. Cypherpunks, Austrian economists, computer geeks, libertarians, traders, Silk-Road customers, family men, Paul Tudor Jones and ultimately your cousin, it’s now hard to find a person who hasn’t heard about Bitcoin.

Why is that? In addition to being a revolutionary technology, Bitcoin is also a currency (bitcoin) with an exchange rate that has increased by hundreds of millions of percent since its inception, about 200 percent annually. This increase has greatly rewarded its early users and still is the talk of the town.

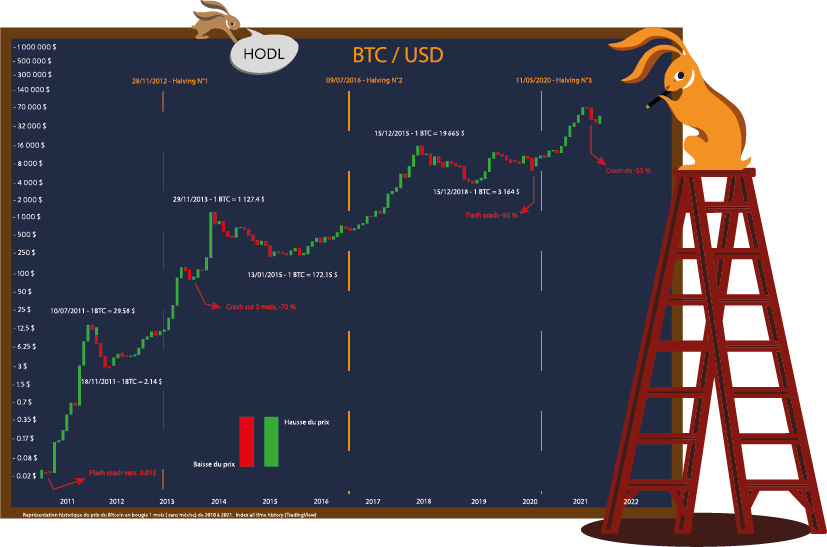

Cycle of speculative bubbles

Its limited quantity gives Bitcoin a rare and unique aspect that attracts investors and skeptics of central bank interventionism. Impossible to devalue, weakly correlated and independent of the system, it has become an asset to hold in one’s financial portfolio. Despite extreme volatility, users know that every 210,000 blocks, halving will create a supply-demand shock that will push the price up. Understanding this, they adopt a long-term strategy (HODL) and thus further reduce an already low supply.

With Bitcoin price back on the rise, skeptics are beginning to ask around and try to figure out why a digital tulip currency is booming while their purchasing power is slowly melting. Some are buying, some aren’t. Bitcoiners keep on dollar-cost averaging (DCA) and eventually a speculative bubble is fueled by hype, media and resulting emotions.

Eventually, the hype dies and the bubble bursts, sending the price down. Traders, gamblers and speculators exit at the expense of serious hodlers and investors who maintain their position in this technology, simply waiting for the next halving and mass adoption.

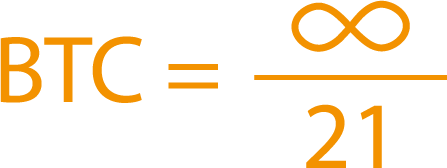

There is a limit of 21 million bitcoins with decreasing production every 210,000 blocks through the halvings guaranteed by adjusting the difficulty every 2,016 blocks.

Adoption of Bitcoin is a social event:the “Red Pill”.

Bitcoin does not need a marketing budget. The users are the marketers and our best argument comes directly from the central banks.

Money printer go brrrrrrr

HODL

A very common strategy among Bitcoiners, HODL means not to sell, no matter the price. With Bitcoin still being a young innovation, its technological potential and monetary value are complex to grasp.

If a large portion of the population were to adopt it to escape the fiat system, the value of one bitcoin could reach several million dollars without much difficulty. Even today, its bullish potential is astronomically high. Nevertheless, Bitcoin’s high volatility means that one has to accept crashes of -25%, -50% or -75% in a matter of days.

Envisioning this future is a risky bet and it will take conviction to keep your bitcoins through time. That’s what HODL is all about: believing in a future where Bitcoin wins and the currency standard becomes the sats.

24 hours a day, 7 days a week

Bitcoin is an open asset: open to use and therefore you’re free to trade.

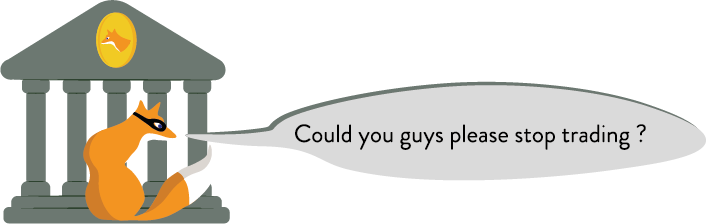

Compared to the traditional stock market, bitcoin exchange platforms run 24/7. There are buyers and sellers in every country, digital or physical, with or without regulation. There are even DEXes (decentralized exchanges) that cannot be stopped even if a judge, a king or a dictator orders it.

For this very reason, Bitcoin is among the favorite assets of traders. With Bitcoin you can’t stop the music and that’s what bothers the regulators… Whether they like it or not, the price can’t be manipulated. Rollbacks are impossible and they have no power to manipulate the change rates. They have to live with the price of Bitcoin.

Section n°2 – Buying Bitcoin

Warning

- Only invest what you can afford to lose

- Bitcoin is a very volatile financial asset, its price can fall to 0

- Past performance is not indicative of future performance

- Reach to your financial advisor if needed

Découvre Bitcoin (Rogzy) does not provide investment advice and none of this should be considered as such.

Buying strategy

How much are you considering to save? How often will you buy?

Dollar Cost Average (DCA)

Recurring purchase consists of buying small amounts at regular intervals. This allows price smoothing over time and a steady growth of our bitcoin holdings.

It’s a perfect solution for long-term savings without worrying about price and volatility. You set it up and forget it.

Beware of UTXOs:

Don’t forget to consolidate your portfolios from time to time.

Spontaneous buying

Spontaneous buying is a means to gain immediate exposure to bitcoin. Whether you want to buy during a crash or take advantage of a bonus, it’s up to you to summon up your courage and press buy.

Bitcoin has huge volatility, so be very careful with your emotions.

Beware of emotions:

FOMO and FUD are your worst enemies!

You stay calm and follow your established strategy.

Bitcoin seller

Who to buy bitcoins from?

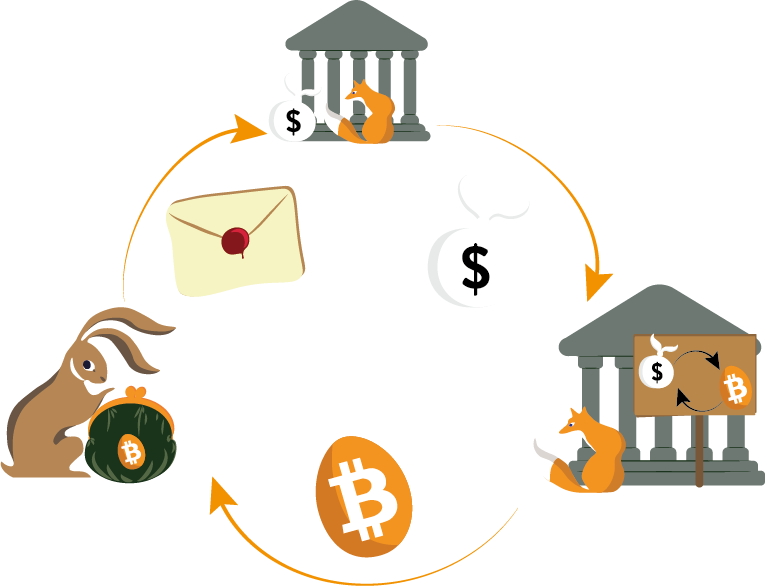

Exchange platform

Exchange platforms are financial institutions that specialize in buying and selling bitcoin. They offer many financial services with lots of liquidity.

Using them is simple and accessible to all:

- Set up a KYC account

- Wire transfer money to your account

- Buy some Bitcoin

- Withdraw your bitcoins to your wallet

Know Your Customer (KYC) standards require users to provide identification to fight terrorist financing, tax evasion and money laundering.

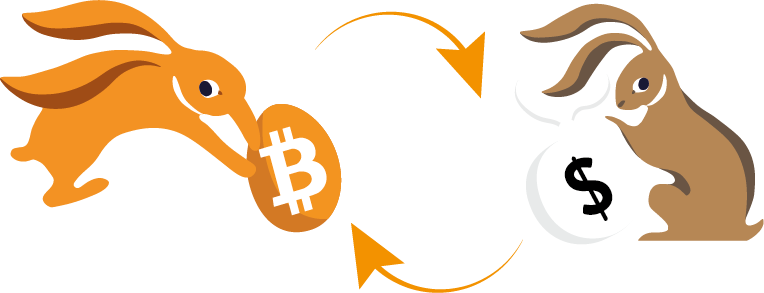

Peer to peer solution

There are several solutions to get hold of bitcoins while respecting privacy.

- Platforms that connect individuals to facilitate physical buy and sell

- ATMs allowing you to change your cash into Bitcoin

- Decentralized online platforms allowing individuals to buy and sell bitcoins directly from their computer

Trade-offs between price, complexity and availability must be taken into account! Peer-to-peer solutions are unregulated and therefore potentially more dangerous for newcomers.

Your bitcoins are now in your wallet. The list of 24 words is secure and you have complete control over your savings.

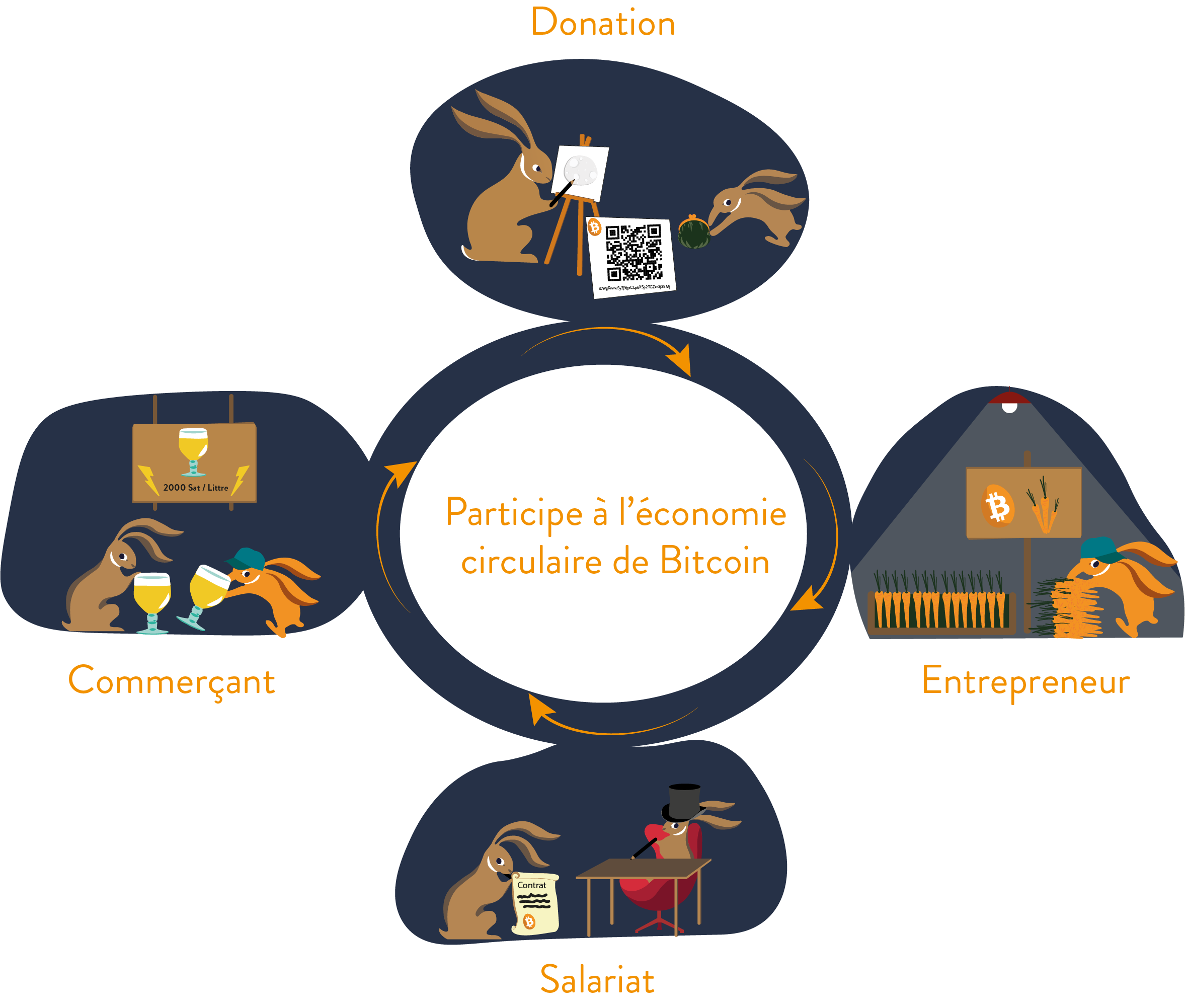

Section 3 – Get Bitcoins by working!

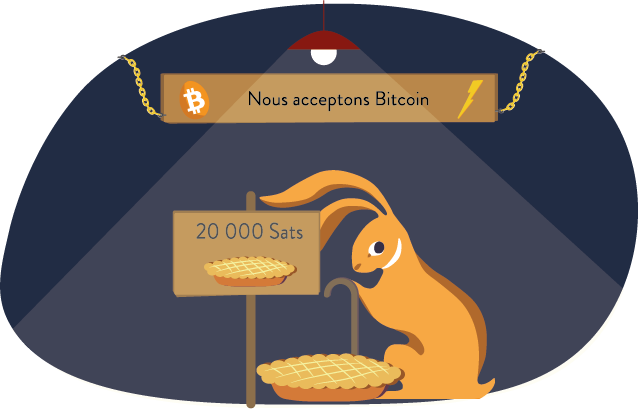

Bitcoin is not just a price, but a tradable currency.

Like many entrepreneurs around the world, you too can participate in the Bitcoin circular economy.

The benefits

Working to get your first bitcoins is a great way to stack sats. Accessible to all, it offers many benefits to beginners and experts alike:

- Emotional detachment from the price

- Understanding of the protocol and technology

- Increased anonymity and privacy

- sing the benefits of Bitcoin and the Lightning Network

Turning your time and knowledge into satoshis is a great way to get the most out of Bitcoin.

Go for it!

Accepting Bitcoin into your life may seem difficult. You have to take into account, among other things, volatility, security, liquidity and regulations.

In order not to discourage you, here are different solutions.

Level 1: Static QR code

Simple, free and accessible to all, a QR code can enable you to receive payments and donations. It is not ideal for privacy and the features remain limited.

It is the simplest solution to accept a first single payment.

Level 2: Dedicated wallet to charge in Bitcoin and over LN

Having a Bitcoin and LN (Lightning Network) wallet for your business allows you to create unique QR codes per customer. The exact payment amount is included in the invoice generated by the wallet.

This is a great solution if you don’t have a lot of volume or transactions each day.

Level 3: BTCPay server

Using a BTCPay instance allows you to generate single payment requests per customer automatically. You are connected directly to your node and your bitcoins are stored on a secure wallet shared between different owners. The Lightning node you use should be well connected with enough liquidity for your business.

You are independent, sovereign and using an extremely robust solution to make it big securely.

You are now your own bank and no one can stop you from working.

You are now your own bank and no one can stop you from working.

The easy solution

Discover BTCPay server! The simple solution to start accepting bitcoin:

- Open-source

- Integrated with Lighting Network

- Privacy friendly

- WordPress integration and easy setup

BTCPay makes it possible for any merchant to use bitcoin. A tool designed by bitcoiners for bitcoiners.

Case study: Citadel 21

100% Bitcoin independent newspaper. This project created by Hodlonaut and Katoshi, took the crazy bet to do everything in bitcoin.

Design, printing, shipping, server and administrative costs are paid in bitcoin. Magazines can only be purchased in bitcoin and Lightning Network via BTCPay.

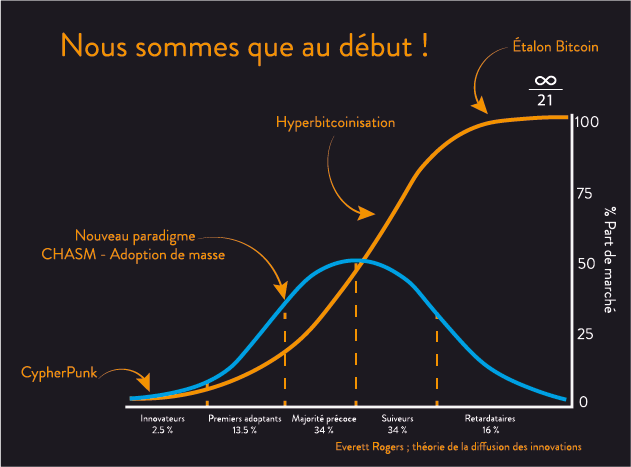

Section 4 – Hyperbitcoinization

Bitcoin in full adoption

Like any new technology, Bitcoin’s adoption follows a very classic distribution curve. We are past the era of early adopters and metrics seem to point to a complete democratization of Bitcoin. Bitcoin is a viral technology that can’t be stopped.

El Salvador took the bet of fully embracing Bitcoin. It has made it legal tender and operates the Lightning Network for everyday use.

Other countries went the opposite way by banning Bitcoin and criminalizing its use. So its adoption will be very complex depending on cultural aspects.

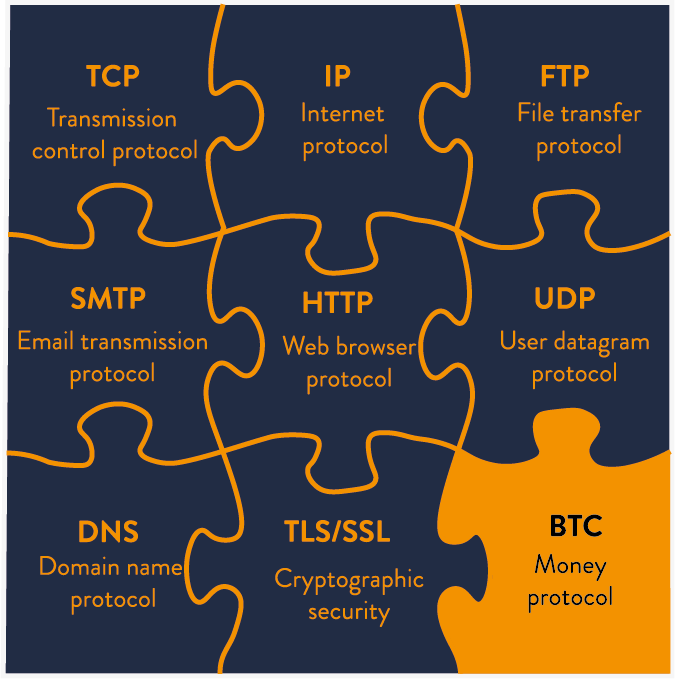

Bitcoin’s multipolarity

Companies, universities, regulators and individuals will have to integrate this new technology.

Designing new tools, adapting their services and carrying on innovation will be mandatory to their survival. If you’re still reluctant to get started, go for it. The industry is recruiting massively on many levels, everything is to be created.

Cryptography

- How can security be guaranteed in a digital world?

- Can we protect the privacy of an individual?

- Is encryption a weapon or a shield?

- Should we tolerate noKYC wallets?

Game theory

- How will states react to the rise of Bitcoin?

- Can you ban Bitcoin? Mining? Nodes?

- Which state will be the first to officially mine Bitcoin intensively?

- Can a central bank afford not to buy Bitcoin?

- What will be the environmental and industrial consequences of Bitcoin mining?

Economics and finance

- How can we create a more just and accessible financial world?

- What is the power of Wall Street and banks in a decentralized world?

- Can we have prosperity and stability without monetary intervention?

- What will be the consequences of a Bitcoin standard?

- Hyperinflation, de-dollarization, how will finance adapt in a 100% digital world?

Computer Science

- How will the Bitcoin protocol evolve?

- Who should have control over the network?

- Which future BIP to implement and how?

- What are the exploitable vectors of attack?

Philosophy, laws and regulation

- Can we accept a financial system with immutable transactions?

- What tools does justice possess to deal with Bitcoin?

- Should human freedom through privacy take precedence over collective security through surveillance?

- Should we stop innovation to maintain the status quo?

The Bitcoin Library

Many authors, thinkers and essayists have contributed to the educational layer of Bitcoin. For the past few years, I’ve been cataloging and categorizing these works to provide a resource library for the more curious among you.

If you’re looking to expand your knowledge of a topic, this is a great place to start. You’ll find the best podcasts, websites, articles, tutorials, books, Twitter posts and other content.

“I think that the Internet is going to be one of the major forces for reducing the role of government. The one thing that’s missing, but that will soon be developed, is a reliable e-cash – a method whereby on the Internet you can transfer funds from A to B without A knowing B or B knowing A.”

– Milton Friedman, economist, 1999

“Welcome to the peaceful revolution!

Through this tour I invited you to think about this new monetary revolution. I hope you enjoyed the experience. There is so much to explore with Bitcoin that it’s hard to include everything at once. Take your time, Bitcoin isn’t going away. On the contrary, the revolution has just begun.

Bitcoin is a major innovation, a “0 to 1”. You’ll be hearing about it again.

I thank you for your time. Together I believe we are capable of creating the world we wish to leave to our children. A world with a right to human sovereignty, where privacy is respected by default and where money is not manipulated. I believe in a world where some of the injustices of the current system are fixed and a new form of freedom, equality and fraternity is offered to us.

I hope that together we will get there.

Have a nice day and welcome to the world of Bitcoiners.”